The Buyer’s Journey

In marketing there is a lot of talk about the “buyer’s journey.” This is a not-so-fancy way to describe the process by which a person discovers and purchases a product or service. So if we’re talking about buying a car, the journey isn’t the picture on Instagram of someone standing next to their new car, dangling their keys with a giant grin on their face. The journey includes everything from online research, to test drives, to financing options, and more.

When it comes to car buying, it’s possible to uncover how a customer got from point A to point B. It may take a bit of leg work, but it can be done. Now, obtaining feedback about each stage of the process can be a challenge as well, but there are plenty of tools to assist marketers and companies with that sort of thing.

These patterns and behaviors exist regardless of the industry under the microscope. It’s up to each individual company to make them work to its benefit.

The Limits of a Snapshot

Take hospitals for example. There is a nation-wide survey that patients complete to evaluate their satisfaction with the care they received following a stint in the hospital called the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS). To up the ante, the Centers for Medicare & Medicaid Services (CMS) have started to tie HCAHPS scores to reimbursement rates. Facilities that don’t fare well in relation to patient satisfaction can lose millions of dollars in government funding.

The point here isn’t to make a value judgment on HCAHPS, certainly it has a role to play and that’s fine. But from the standpoint of a healthcare provider it’s worth pointing out that the HCAHPS survey is a snapshot of the end result. This is equivalent to using a post-call survey, and nothing else, to gauge and manage customer experience. Typically, there are a battery of other appointments, tests, and interactions that precede a hospitalization that all influence the way a patient perceives their care.

Critical Context

The survey asks patients to rank things like doctor and nurse communication, pain management, and discharge instructions. These things don’t exist in a vacuum though; context is important. If someone goes into the hospital for knee surgery they’re going to compare the care associated with that procedure with all the appointments leading up to it. That’s the baseline, and there’s nothing wrong with this type of contextualization either. It’s natural and almost impossible to prevent.

This contextualization phenomenon is by no means limited to the healthcare industry. To make matters more complicated, customers don’t just consider a specific purchase in light of the research that led up to it. Yes, customers weigh the entire buyer’s journey, from discovery through purchase. But this is just a single component of out of several used to determine quality of service. Customers are also, in fact, comparing apples and oranges.

Companies in unrelated industries still bear in the mind of customers. Therefore, a car dealership or a hospital has to contend with expectations engendered by Target, USAA, or Comcast. Some may be easier to top than others, but essentially what results is a continuum between good and bad. In essence, consumers walk around with the equivalent of a personal Temkin Customer Service Rating in their head.

Keeping tabs on other companies and how they stack up in relation to customer satisfaction amongst one’s target market can help determine where on the continuum they fall and how to move in the correct direction.

Industry Advantages

Getting back to our healthcare example, one could argue that HCAHPS results both reflect the care provided at a specific hospital and the cumulative experience of the healthcare interactions that led up to that hospital stay.

What would be useful for healthcare providers is not just relying on that end-of-the-line snapshot, but periodic snapshots throughout the entire patient’s journey. This allows providers to diagnose the cause and not just the symptoms of customer experience, and to take corrective action in the appropriate places. Think of it like a movie or an animated gif, something that includes movement and direction rather than a static photo.

The recent push to increase the use of electronic medical records stands as an area where healthcare providers can tap into patient data and begin to fill in the rest of the picture with pre- and post-hospitalization information. Every interaction is documented and easily accessible. This intrinsic inter-connectivity should make connecting the dots relatively easy.

Not only would this allow healthcare providers to uncover a more comprehensive view of the patient’s journey, and reveal points for soliciting additional feedback along the way, but partnering with insurers would allow facilities to control for a wide range of variables, such as cost, practice, doctor, medical specialty, insurance type, duration of care, number of interactions, and many more.

Thanks to electronic medical records the healthcare industry has a built-in advantage when it comes to understanding the patient’s journey. The sooner that providers can tap into that information, the sooner they will be able to reap the benefits of improved patient satisfaction.

Get the Whole Picture

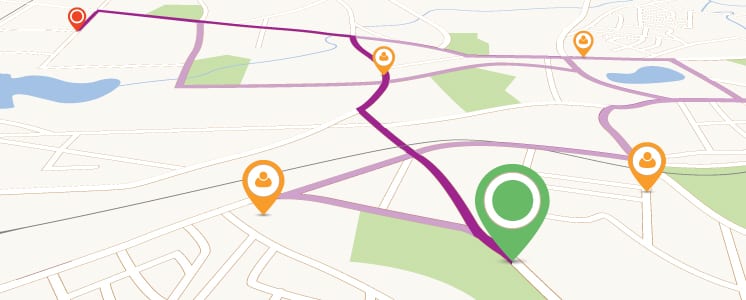

Regardless of industry, the salient point here is that customer experience is not a fixed point on the map, something that one can easily point out after a quick glance. Any mapmaker will tell you that a map is made up of points, lines, and polygons. To consider only of these is to navigate without a full complement of information.

The same goes for gauging customer experience. Monitoring the end-of-the-line snapshot will tell companies about their successes, but there are many more people who took an alternative route on the buyer’s journey, and there is important information to be gleaned from abandonments, too.

Understanding where buyers end their journey begs the question of why they abandoned in that place. This renewed focus enables companies to refine their customer offerings along the entire journey and, over time, to create a fine-tuned customer experience from awareness through purchase, and after.

Depending on the questions being asked surveys, phone calls, and messaging are all great options for soliciting information about various aspects of the customer’s journey.