The true test of how effective your IVR solution is often lies in the containment rate. This corresponds to how many callers use, or are contained within, the IVR from the entirety of their transaction. That means not abandoning the IVR to speak to a live agent.

Now IVR technology is a huge boon to payment processing. It gives people an easy-to-use, easy-to-understand payment channel that is available 24/7/365. Companies can set up their IVR to be as user-friendly as possible, but there are still some factors that lead callers to hit the ole zero button and transfer out to speak with a live agent.

Luckily, with VoiceTrends, it’s easier than ever to identify bottlenecks and trouble areas in your IVR. But even when you know where callers are bailing out of your IVR, it isn’t always clear why they’re doing so.

Here are some common ‘whys’ that we’ve found over the years.

Get Clear

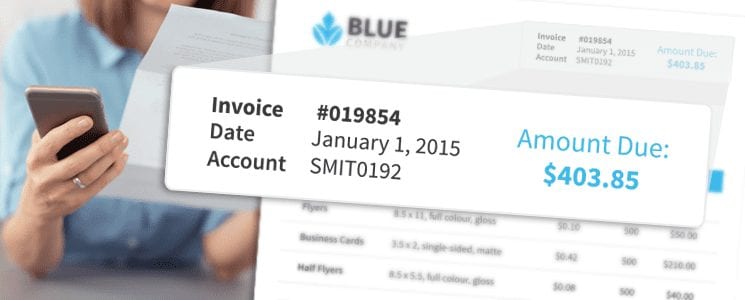

Let’s think about the workflow that callers go through to make a payment. Typically, they receive a paper bill in the mail, and then call your IVR to make a quick payment.

To ensure that your system processes everything correctly it’s necessary to have the caller input some sort of identifying information. This can be anything along the lines of a customer number, an invoice number, or an account number.

One of the biggest problems that callers have is that when they call, they spend too much time looking for the necessary information on the actual bill. What ends up happening is that the IVR times out before they find it. Depending on the IVR’s default behavior this could result in looping the caller back to the main menu, or it might even terminate the call.

The next step is to call back and re-do the whole transaction, or simply transfer to an agent. Neither of these presents a good customer experience.

To get around this problem, make sure that the necessary information is clearly indicated on the paper bill. Using a bold font for the most important information is a great way to draw attention to it.

It’s important to make sure that the language you use is consistent between the actual bill and your IVR. Don’t call the same piece of information an account number on one and a customer number in the other.

Get Organized

Another analog solution, related to the clarity issues, revolves around organization. Think about what customers see when they look at their bill. Place all the relevant payment information right next to each other, e.g. total due, phone number, identifying information, etc.

If the bill total is listed in the top right corner, the customer information in the bottom left corner, and the phone number and website are listed on the back of the bill then customers tend to have more trouble completing transactions.

Put ALL that information in the same corner, on the same side of the bill to make the payment process easier. It’s even a good idea to list those pieces of information in the same order on the bill that your IVR asks for them.

This is another place to make sure you have consistency across all your payment channels. Ask for the same pieces of information in the same order regardless of whether customers are paying by phone, the web, or any other channel.

Get The Message Across

As a payment processor, you want customers to pay bills as quickly as possible because that translates to more cash flow for your company. One way to ensure that customers pay bills before they become delinquent is with automated, proactive notifications.

Using messaging, either SMS or MMS, for this type of communication not only has a high engagement rate, but it’s also easy to setup and integrate directly with your IVR. Messaging is also very cost-effective.

Just make sure that the information you present to customers via text message is consistent in terms of content and structure with the rest of your billing system.

So, there you have it. Three different strategies–two analog, one digital–that help you deliver a better customer experience for your IVR payments application without having to lay a single finger on the IVR itself. We’ve seen customers with containment rates in the 50-60% range jump all the way up to 90% simply by making these types of changes.